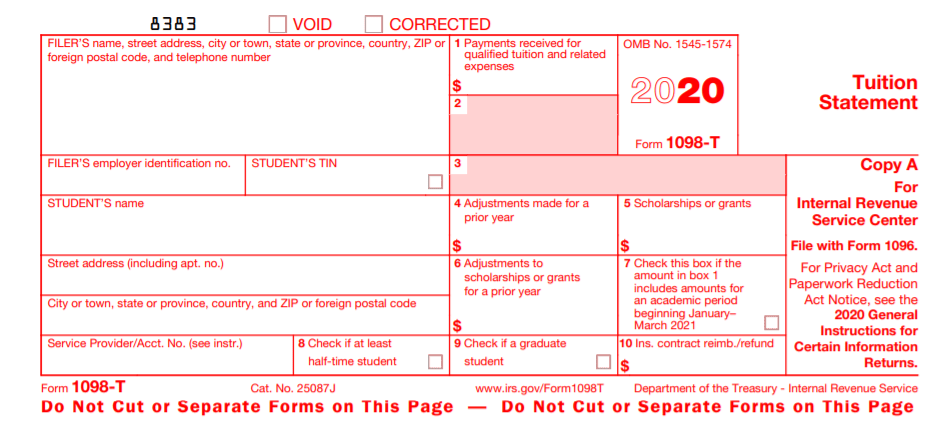

The IRS has created Form W-9S for use specifically in collecting an SSN from students. This statement is required to support any claim for an education credit. This statement has been furnished to you by an eligible educational institution in which you are enrolled, or by an insurer who makes reimbursements or refunds of qualified tuition and related expenses to you.

1098 T QUALIFIED EDUCATION EXPENSES CODE

In accordance with the Privacy Act of 1974 and Indiana Code 4-1-8, enrolled students are advised that the requested disclosure of the Social Security number is voluntary. education credit on Form 1040 or 1040-SR. Taxpayers should refer to IRS Publication 970, IRS Form 8863, or their personal tax advisor to determine if they qualify for an income tax benefit. Indiana University is not permitted to provide tax advice or assistance to taxpayers in determining eligibility or calculation of the appropriate amount to claim for the education related income tax credits or deductions. However, the enrollment information by itself does not establish eligibility for either credit or deduction. Qualified educational expenses include tuition, any fees that are required for enrollment, and course materials the student was required to buy from the school. Tuition and Student Activity Fees which are typically Box 1 or Box 2 of the Form 1098-T Expenses for course related books, supplies and equipment ONLY if the. The Act requires eligible educational institutions to report certain enrollment and financial information on Form 1098-T to students and the Internal Revenue Service. Taxpayers who pay qualified educational expenses at an eligible educational institution may qualify for the American Opportunity Credit, the Lifetime Learning Credit, or the Tuition and Fees Deduction.

The Taxpayer Relief Act of 1997 created income tax benefits for students attending an eligible educational institution with qualified education expenses. IRS Form 1098T is a Tuition Statement provided by higher education institutions to students to report scholarships, grants and other payments of qualified.

0 kommentar(er)

0 kommentar(er)